Understanding Capital Expenditure and Depreciation for Manufacturing Companies

In the dynamic world of manufacturing, staying ahead of the competition requires continuous investment in equipment, infrastructure and technology, writes James Haywood, Partner at Page Kirk.

Capital expenditures (CAPEX) play a vital role in the growth innovation and operational efficiency of manufacturing companies. However, it is imperative to have a comprehensive understanding of CAPEX and its counterpart, depreciation, to make well-informed decisions and effectively navigate the complexities of financial management in the manufacturing industry.

In this article, we will explore what CAPEX and depreciation are, the various types that exist, and their impact on manufacturing companies.

What is CAPEX?

CAPEX refers to the funds invested by a company to acquire, improve, or maintain its long-term assets. These assets are instrumental in generating revenue and enhancing operational efficiency. Unlike regular expenses which are deducted off a company's profit, these are capitalised on the balance sheet and gradually expensed over their useful life through depreciation. CAPEX decisions are crucial as they have long-term implications for a company's financial health and competitive position.

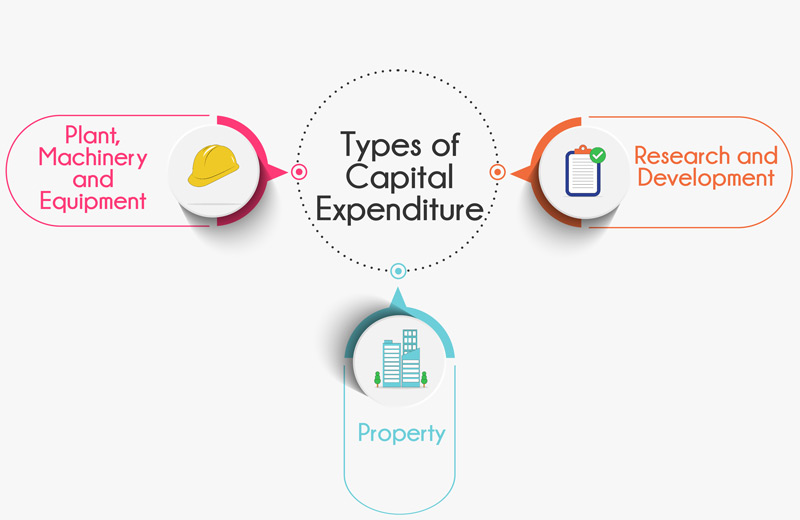

Types of Capital Expenditure

- Plant, machinery and equipment: This refers to assets such as production machinery, vehicles and specialised tools, fall under this category. These assets are essential for manufacturing companies to streamline their operations and improve productivity.

- Property: This refers to investments in land, buildings, factories and other physical structures. These assets provide the foundation for a manufacturing company's operations and facilitate expansion and growth.

- Research and Development (R&D): Manufacturing companies often invest in R&D to innovate and develop new products, improve existing processes and enhance competitiveness. These expenditures are normally capitalised within intangible assets and contribute to long-term growth and technological advancements.

What is Depreciation?

Depreciation is the reduction in the value of a company's long-term assets due to wear and tear, obsolescence or the passage of time. Since CAPEX is not expensed immediately, depreciation allows companies to allocate the cost of assets gradually over their useful life. This accounting practice aligns expenses with the economic benefits derived from the assets.

Types of Depreciation

- Straight-Line Depreciation: This is the most common method of depreciation, where the cost of an asset is evenly allocated over its useful life. Each year, an equal portion of the asset's value is expensed, resulting in a steady depreciation expense.

- Reducing Balance Depreciation: This method applies a higher depreciation rate to an asset's early years and gradually reduces it over time. It reflects the assumption that assets are more productive and valuable in their initial years.

- Units of Production Depreciation: This method bases depreciation on the actual usage or production capacity of an asset. The depreciation expense is determined by the number of units produced or the hours the asset operates.

How CAPEX and Depreciation Affect Manufacturing Companies

CAPEX and depreciation have a significant impact on manufacturing companies' financial statements, profitability and cash flow. Here's how:

Financial Statements: CAPEX are reflected on the balance sheet as Non-current assets, increasing the company's asset base. Depreciation, on the other hand, is recorded as an expense on the income statement, reducing the company's net income and taxable income.

Profitability: CAPEX directly contribute to a company's profitability by enabling cost savings, improved efficiency and increased production capacity. However, the depreciation expense reduces net income, resulting in lower reported profits.

Cash Flow: CAPEX require substantial cash outflows, which can strain a company's cash flow in the short term. However, the depreciation expense provides tax advantages by reducing taxable income, thus generating potential cash flow benefits.

Why Choose Page Kirk?

When it comes to managing capital expenditure and depreciation for manufacturing companies, partnering with a knowledgeable and experienced accountancy firm is crucial. Page Kirk has a proven track record of assisting businesses in navigating complex financial matters and optimising their financial performance. Here's why choosing Page Kirk is the right choice:

Industry Expertise: Page Kirk specialises in serving manufacturing companies and understanding their unique challenges and opportunities. Our team of accounting professionals has in-depth knowledge of capital expenditure and depreciation specific to the manufacturing sector.

Tailored Solutions: Page Kirk provides customised solutions based on your company's specific needs and goals. We work closely with clients to identify opportunities for cost savings, tax advantages and improved financial management.

Compliance and Reporting: Page Kirk ensures that your capital expenditure and depreciation practices align with regulatory requirements and accounting standards. We help you stay compliant while maximising the financial benefits for your manufacturing business.

Strategic Advice: Beyond accounting services, Page Kirk offers strategic advice to help manufacturing companies make informed decisions regarding capital investments, expansion plans and growth strategies. Our insights can contribute to long-term success and sustainable growth.

Understanding capital expenditure and depreciation is essential for manufacturing companies to effectively manage their financial resources and achieve long-term success. By understanding the types of capital expenditure, such as machinery, infrastructure and R&D – and the various methods of depreciation, including straight-line, declining balance, and units of production – businesses can make informed decisions about investments, profitability and cash flow.

Choosing Page Kirk as your accounting partner ensures access to industry expertise, tailored solutions, compliance support and strategic advice that can optimise your manufacturing company's financial performance.

To find out more about what we do and to get in touch with us today, call 0115 955 5500 or email enquiries@pagekirk.co.uk.