Top 5 Time Savers for Bookkeeping

Are you manually inputting receipts and reconciling bank statements? Don't waste precious time that could be spent with your kids, catching up with friends or focusing on growing your business. Josh Smithurst from our cloud accounting team understands the value of time, so he's here to share his five top tips to saving-time when it comes to bookkeeping.

As we all know, time is a valuable thing. It should be spent doing the things we enjoy: socialising, exercising and spending time with friends and family. However, you choose to spend your free time, I think we can all agree on the fact it shouldn't be spent manually inputting receipts and ticking through bank reconciliations.

I have therefore put together a list of my top five biggest time savers when preparing bookkeeping for my clients, and what you can implement in your own business today!

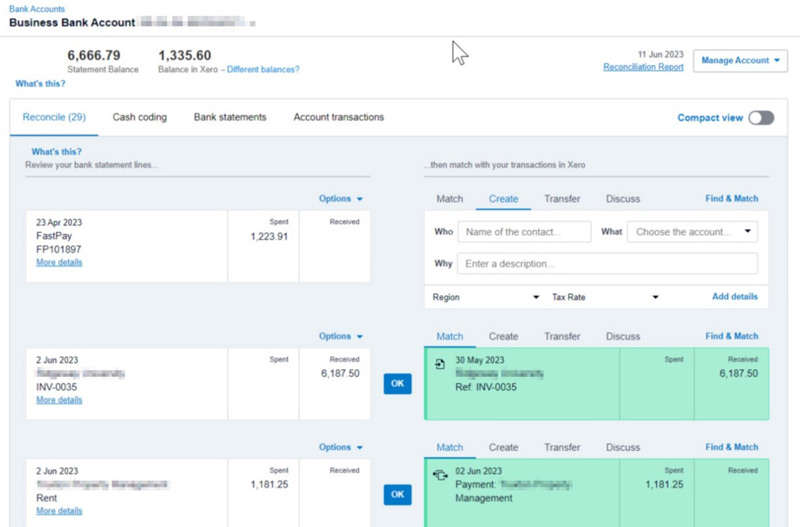

Automatic Bank Feed

This is a game changer. It's an absolute nightmare to reconcile a few bank accounts by manually entering each transaction line individually, just for you to have to tick them back to find a small difference or discrepancy.

With an automatic bank feed, the transactions can pull through to Xero or QuickBooks and sit in a review page, ready for you to match to an invoice or categorise.

Once all these transactions are processed and reconciled, Xero and QuickBooks even produce a reconciliation report, to agree the bank statement to the amount on the software and show where any differences occur.

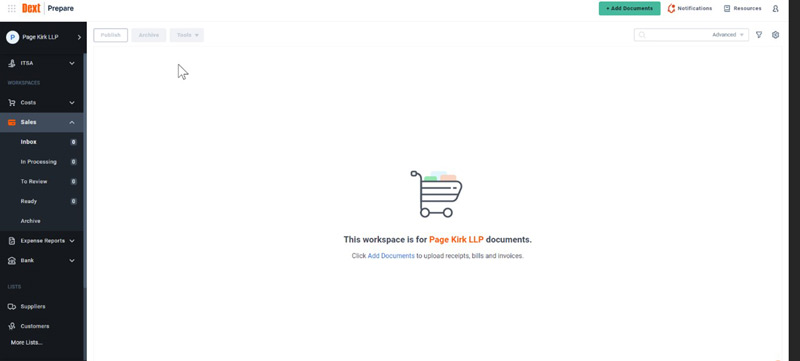

Dext Prepare

Dext Prepare is a piece of software that is used primarily for collating and extracting the data from invoices, whether that is sales invoices, purchase invoices or cash receipts.

You can set rules to automate most of the processing involved, including setting nominal codes, tax rates and suppliers. Which saves countless hours over the year when you are processing invoices.

Keep Personal and Business Transactions Separate

If you only have one bank account for both business and personal use, then you will likely spend most of your time deciphering whether that café receipt was from the time you were entertaining a client, or the time you went at the weekend with the family.

Having separate bank accounts will reduce the time spent on these types of problems. What's more, it will allow you to keep track on how much money is yours to spend as you wish and which is related to the business and needs monitoring.

Little and Often

It's not the same for everyone, but personally speaking, I find if I am working on a job year-round and I allocate some of my time each day, or each week to the job, I will end up spending less time over the course of the year.

This is because I am spending less time on the job, each time I work on it. So, I am less likely to hit the wall and start to lose focus. If I leave a job to the end of the quarter, however, and have the whole period to cover, I will lose my focus more quickly, as it can be daunting to know how much work I must do, having left it all to the last minute.

Set Tasks and Rewards

Bookkeeping can become quite mundane, especially for people who are not accountants. This is why it is important to set a list of tasks to complete each day, week or month and, once you have completed some, half or all of them, treat yourself. If you are finished, you can work on projects you do enjoy, indulge in some food and drink, or even take the rest of the day off. This will help you remain motivated throughout your tasks and keep you productive.